Multifamily Investments and Renter Trends

The COVID-19 pandemic had detrimental impacts on apartment rents nationwide as renters went into forbearance. Rent payments have now returned to normal, with rent growth across the country exceeding historical trends. Over half of all U.S. apartment households were paying over 30 percent of their income on rent along in 2020, and with recent rent growth that percentage is expected to increase. Experts have recognized three distinguished types of burdened renters: low earners, geographically burdened households, and high earners. There is not a one size fits all policy that will be effective in this case since every apartment owner’s situation constantly varies.

Rental Affordability

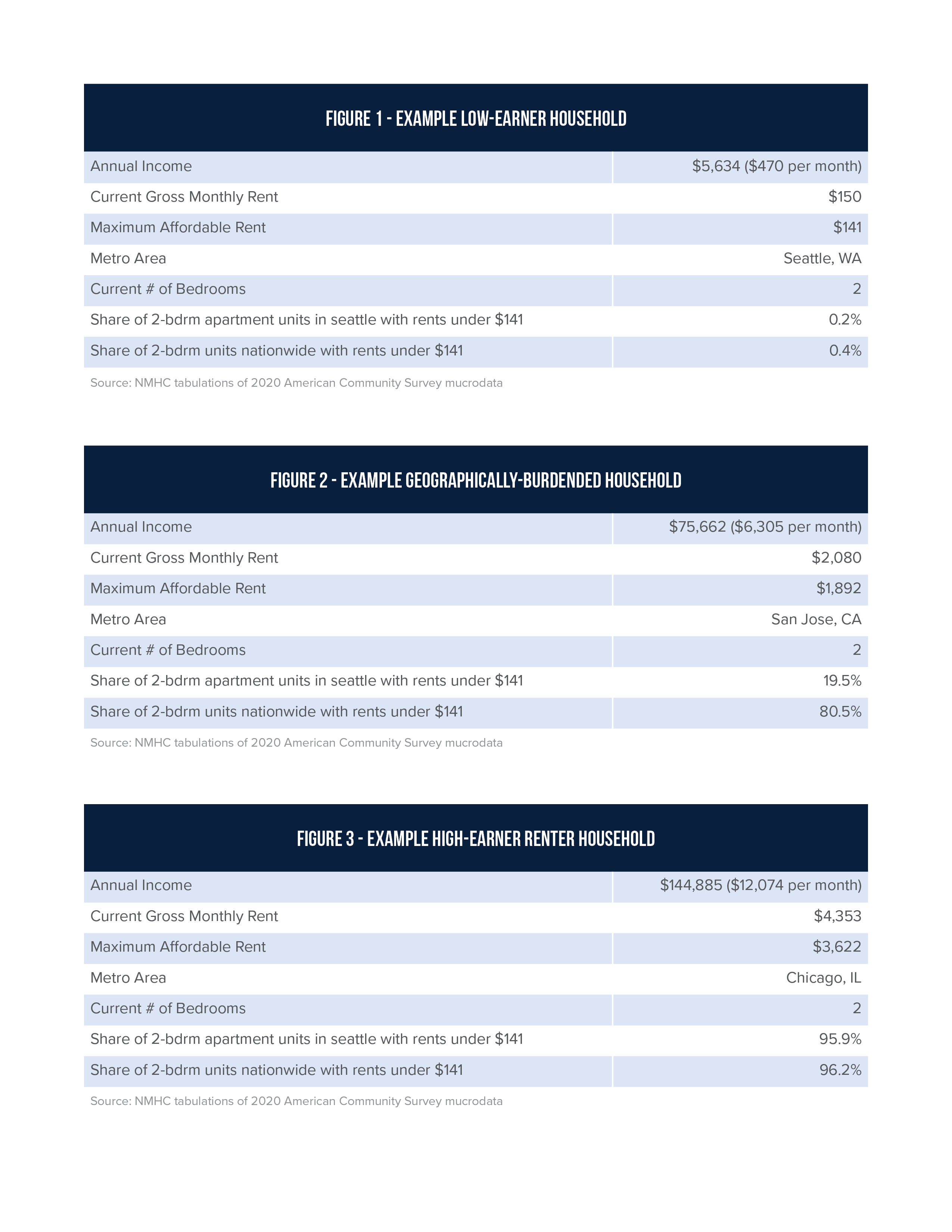

Low earners make up 23 percent of all burdened apartment households, the largest group of the three. Low earners are burdened because they do not have a sufficient flow of income to keep up with inflation and rising rent growth. Low earners include renters that could not afford more than five percent of the apartment units within their current metro area and across the country without dedicating more than 30 percent of their income to rent. Ninety percent of low-earner households were severely cost-burdened in 2020, indicating that deep subsidy is needed to enable them to relocate to an affordable unit. The metro areas with the highest shares of severely cost-burdened low-earner apartment households include Dallas-Fort Worth, Las Vegas, and Tampa.

Geographically burdened households earn a moderate income, but since they live in more expensive markets, they are considered cost burdened. This group makes up 15 percent of all burdened apartment households. If the people in this group were to move into more inexpensive housing markets, or if more units were built in their existing housing markets, which would alleviate pricing pressures, it is likely that this group would no longer be burdened.

High earners only make up four percent of all burdened apartment households. This group includes very high-income apartment households who choose to pay more than 30 percent of their income on rent, even when they have the option of more affordable housing in their area. These households are considered cost burdened but do not typically need financial assistance.

Increased Apartment Rents In Florida

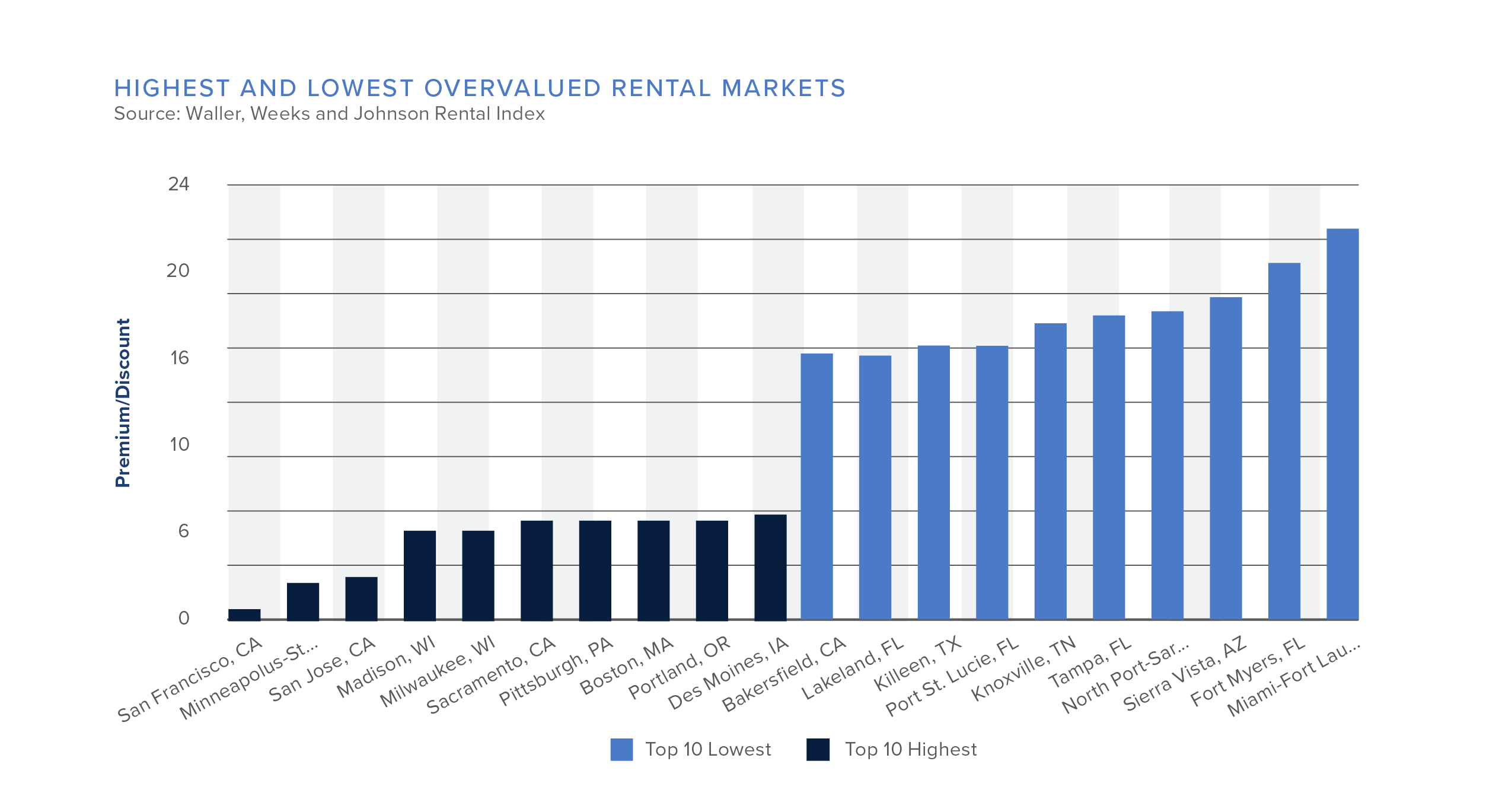

There is a large percentage of overvalued U.S. apartment rents in Florida. Six of the state’s metropolitan areas are among the top 10 for the most significant premiums renters are currently paying. Economists at Florida universities who have tracked the rental increases in the state over the years found that rents typically increased two to three percent each year. But, in recent years, rents are 9.85 percent above where they should be across the country. Miami’s metropolitan area topped the list at 22.7 percent, with a 31.04 percent year-over-year change, making it one of the most competitive market and is being called the “epicenter of the housing crisis in the country,” according to CoStar.

Overall, an evident rental rate crisis is affecting residents all over the country. Additional supply will not be adequate in solving the issue for low earners, as they will still be unable to afford market-rate housing without financial or government assistance. It is strongly recommended that additional apartments are built in more expensive areas to help ease housing cost burdens for those in the geographically burdened households category.