Repurposing of the American Mall

First introduced in 1956 in Edina, MN, the shopping mall became a cornerstone of the American retail experience. Malls captivated shoppers, offering a vast array of goods in a centralized location and cultivating a cultural phenomenon. Over the years, changing consumer preferences and the strength of e-commerce pivoted shoppers away from traditional malls, leaving owners and developers with empty square footage. However, malls are making a comeback, but not in the traditional sense. Owners and developers are getting creative, redefining a mall’s purpose through strategic repositioning.

The Fall From Grace

Shopping mall fundamentals were declining pre-pandemic, and the onslaught of COVID-19 exacerbated the sector’s challenges even further. Vacancy rates rose throughout the mall sector, and anchor tenants, once considered “safe,” began shutting their doors. Nordstrom, Macy’s, and JCPenney closed a large number of their stores, while other well-known anchors such as Barney’s and Lord & Taylor shut down operations entirely. The empty anchor spaces’ enormity didn’t fit modern retailers’ needs or vision, leaving thousands of square feet bare, burning a hole in the owner’s pocket.

Once quintessential to a mall’s foot traffic, anchor tenants are exiting the market rapidly.

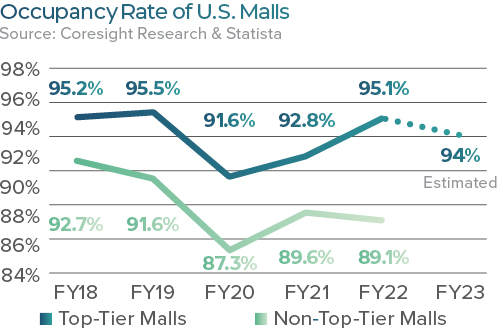

Although all malls saw a decline in performance in 2020, there has been a significant variation in performance throughout the sector since then. Class A malls rebounded quickly post-pandemic and continue to report relatively strong rent growth and lower vacancy rates compared to Class B and Class C malls. On average, U.S. malls reported a lower rate of 3.1% annual rent growth in Q4 2023, according to CoStar Group. Top-tier malls are seeing more positive rates in terms of occupancy as they attract and retain profitable tenants. Due to low foot traffic or a less desirable location, mid to low-tier malls often cannot attract newer brands that bring in either higher-end or a younger customer base, increasing their vacancy rates. The average vacancy rate for all U.S. malls in Q4 was 8.5% , although malls with one or two anchor vacancies reported a much higher rate.

Mall Tiers

- Top-Tier Malls feature luxury retailers and newer direct-to-consumer (DTC) brands; often located in more affluent areas where a typical shopper has an annual income of over $200,000.

- Mid-Tier Malls have anchor retailers and fewer vacancies; located in moderately affluent neighborhoods where a typical shopper has an annual income of around $100,000.

- Low-Tier Malls have at least one, and sometimes two or more empty anchors, declining sales, and a less-affluent customer demographic.

While shopping malls face challenges, there are several positive attributes to the industry. According to ICSC, retail expenditure at malls grew 11.2% from 2021 to 2022, and 12.9% of U.S. consumer spending went through malls in Q1 2023, helping indoor malls achieve higher sales productivity compared to more modern, open-air complexes. In addition, retail development is limited, so new deliveries are not a threat to the sector. The dominance of e-commerce is weakening as consumers return to in-person shopping. E-commerce only accounted for 15.6% of total retail sales in Q3 2023, reported by the U.S. Census Bureau, meaning there is plenty of capital for malls to capture.

Pivoting With Purpose

The headlines spuing that the traditional mall is dying aren’t necessarily accurate. Not all shopping malls are dying; many are adapting and innovating to move into the next era of retail. Owners and developers are listening to consumers and pivoting the aged idea of what a mall looks like and what a mall offers through strategic redevelopment and repurposing.

Nearly 2 in 3 (61%) Americans want to see a revival of the shopping malls. Source: IPX 1030

Medtail

There is a consistent increase in the amount of retail space being leased to healthcare tenants. To combat vacancies, owners are opening spaces to brands outside of traditional retail, such as urgent cares, med spas, clinics, and more. Typically, healthcare tenants take up smaller tenant space as a compliment to an anchor, but some companies found success by replacing anchor tenants to accommodate larger facilities. For example, Novant Health acquired the former Sears building at HanesMall in Winston-Salem, MA, opening an 18,600-square-foot freestanding orthopedic clinic in its place. Co-locating healthcare and retail brings in an additional customer base, increases accessibility to healthcare, and strengthens food services within the mall. To note, the cost of repurposing into healthcare is often higher at $200 to $300 per square foot as they require more specialties than retail buildings, according to a report by ICSC.

Live.Work.Play

The modern renter is looking beyond an apartment’s location or square footage, instead focusing on the lifestyle an apartment can offer. Mall developers and owners have taken advantage of this trend by repurposing older malls into mixed-use developments that feature multifamily, retail, office space, and entertainment in one location. These models cater to a larger audience, providing an experience rather than just a place to shop. Often, live.work.play centers offer social gathering areas in beautiful courtyards, local’s favorite eateries, and an entertainment-focused tenant. Trampoline parks, go-karting raceways, interactive museums, luxury bowling alleys, etc. are popping up in mixed-used complexes, as they successfully bring Gen Zers to the property and encourage consumers to stay longer. The ability for renters to eliminate their commute to work, and the city’s best restaurants, shops, and activities creates a mix of leisure and business that is highly desirable to the modern consumer.

Almost two-thirds of Gen Z consumers say they go to malls for the social aspect, not for any specific product. Source: ICSC

Replacing Anchors

The massive space left behind by former anchors created a severe issue for mall owners. Over the last few years, owners have found repurposing the anchor buildings for multifamily or hospitality use a successful approach. Converting big box stores into apartments or hotels is a sustainable solution to the large quantity of square footage and attracting new generations of shoppers. Hotels bring in additional revenue from tourists, and multifamily brings a built-in customer base. It’s important to note that when replacing anchors, owners must research to ensure the current tenants match the demographics of the desired renters or tourists.

A 200-room hotel with an average 70% occupancy rate and an average stay of 2 nights per guest and 1.25 guests per room will generate approximately 32,000 potential unique visitors to the mall. Source: Intalytics

If an owner is unable to replace anchors with viable tenants, converting the space for a different use is a good alternative. Many older malls have been redeveloped into warehouse space, helping the community add industrial space without the negative environmental effects new construction can have.

Boxing Small Shop Space

Another successful approach to repurposing underutilized space is boxing, a strategy where owners create larger spaces within the mall by combining small shop space that is harder to fill. Typically, malls have a combined small shop space of 250,000 to 300,000 square feet, but fewer small shop space tenants are looking to lease within traditional malls. So, by sectioning off the square footage into a larger format, the owner now has less small shop space for lease and can attract large shop space tenants who may not typically consider leasing in a mall, diversifying the portfolio.

What The Future Holds

With the current economy suggesting a softening in consumer spending, mall fundamentals will likely tighten next year. Class B and Class C will struggle most to attract and retain profitable tenants, whereas Class A malls will remain resilient. In-person shopping is predicted to stay as consumers practice the “halo effect,” where they research their favorite items online but visit a physical store to purchase said items. Brands are seeing the benefits of having both an online and physical presence, helping malls stay relevant and competitive within the retail space. This year will be difficult as interest rates remain elevated, but there are opportunities for owners and developers to continue to innovate. Overall, the great American shopping mall is undergoing metamorphosis, transforming its exterior and proclaiming a new purpose.