What to Know About the Cannabis Real Estate Industry

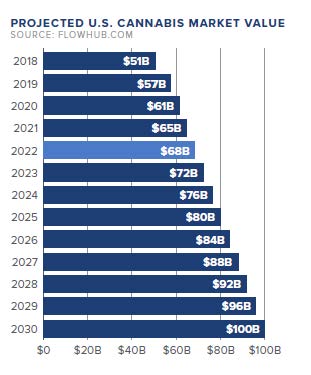

The Cannabis sector of real estate is one of the newer niche asset classes to come into play in the industry, offering plentiful room for growth. But net lease investors have started taking notice of the opportunities these assets provide, and demand has risen throughout the years. As marijuana continues to be legalized throughout the country, cannabis dispensaries are looking to expand their footprint. As states continue to legalize cannabis, the market continues to increase in size. Currently, there are 38 states in which medical marijuana is legal and 18 states in which marijuana has been legalized for recreational purposes. In 2021, cannabis sales reached $26.5 billion and are expected to reach $32 billion in 2022. The industry’s compound annual growth rate (CAGR) is predicted to be 11 percent between 2020 and 2023, eventually putting the sector’s worth at more than $57 billion in 2030.

The Wall Street Journal reported that the cannabis industry could be valued as high as $100 billion by 2030.

As the industry continues to see heightened consumer demand and rapid legalization, it is becoming more and more probable that cannabis outperforms former sale predictions.

Cannabis Real Estate Overview

U.S. consumers encourage the swift movement for cannabis dispensaries in their communities, with 91 percent of adults saying marijuana should be legal. Sixty percent of which supported marijuana being legal for recreational use, and 31 percent supported medical use only, according to the Pew Research Center. In total, the U.S. boasts approximately 7,490 dispensaries across the country, with Oklahoma leading the pack at 2,129 statewide. California is second for the most facilities per state, with 1,440. Some regions are experiencing faster growth than others. The Northeast grew substantially in dispensary count, as did some major markets in the Midwest.

“According to Green Market Report, as of March 2021, there were 424 dispensaries in the Northeast which proves the industry has grown at a fast paste from having just 187 dispensaries back in 2018.”

Although the industry saw a downtick in transaction activity at the beginning of the global pandemic, the asset class rebounded quickly after being deemed essential. For example, North American cannabis companies raised over $1.6 billion in January 2021. These strong numbers renewed interest for investors and the sector has seen high demand ever since.

A few key players in the cannabis industry include the following:

- Trulieve: +155 Stores , 8 Operating States

- Curaleaf: +135 Stores, 23 Operating States

- Surterra Wellness : 45 Stores https://www.surterra.com/stores/

- The Green Solution : 20 Stores, 1 Operating State

- Flent: 27 Stores, 4 Operating States

- Beyond / Hello: 28 Stores, 5 Operating States

- MedMen: +25 Stores, 6 Operating States

- The Botanist: 16 Stores, 5 Operating States

- Rise: 31 Stores, 9 Operating states,

- Green Goods: 14 Stores, 3 operating states

Why Invest in a Cannabis Dispensary?

Cannabis dispensaries have become a more attractive opportunity for passive investors for several reasons. The properties continue to prosper due to the tenants’ solid lease structure. Cannabis dispensaries are corporately guaranteed leases that typically leave the landlord with little to no responsibility. Typically having an initial lease term of ten or more years, dispensaries also include annual rent increases, helping investors take advantage of rising rent rates across the U.S. Due to rising rates, long-term owners often receive higher rents than their previous tenants. Although cap rates continue to compress for cannabis dispensaries, investors can receive higher yields in a long-term corporately guaranteed lease compared to traditional corporately backed asset classes such as banks, pharmacies, and tire stores.

Pandemic-Resistant Asset Class

While many investors faced challenges such as rent abatement and a high vacancy rate during COVID-19, cannabis dispensaries were able to continue operating and proved to be recession-proof tenants. In fact, cannabis dispensaries were declared to be an essential business. In total, nearly 30 states deemed marijuana businesses as essential. During COVID-19, many dispensaries began offering contactless services like curbside pickup, home delivery, etc. In some markets, cannabis sales increased more during the pandemic than in the previous two years.

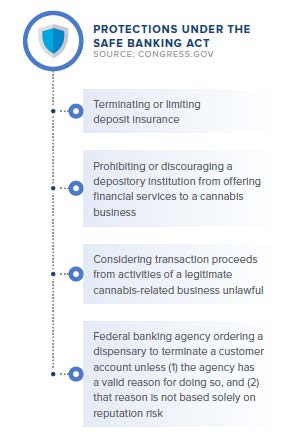

SAFE Banking Act

When cannabis dispensaries first entered the commercial real estate market, many owners faced insurance and financing challenges due to the illegalization of marijuana in most states. This is now a problem of the past with the passing of the SAFE Banking Act. This bill prohibits federal regulators from punishing banking institutions solely due to them providing finance services to cannabis companies, company owners, and their employees. Risks vary for each commercial real estate sector but are never non-existent. Cannabis facilities will likely always present compliance disputes, but those willing to invest and manage the relationships successfully will reap compelling rewards.

From Banks to Cannabis Real Estate

Over the last decade, brick and mortar retail has shifted as fewer consumers are seeking the traditional shopping or in-person service experience. This shift has caused banks to either adapt to evolving customer needs or close. S&P Global Market reported banks had a record number of closings in 2021, shutting down 2,927 branches throughout the U.S. In all, the shuttering of banks has presented opportunities for retail investors looking to expand or diversify their portfolios.

Many vacant banks proved to successfully transition into cannabis dispensaries as the industry took off and the banking sector slowed down. Banks are usually located in high-traffic and accessible locations, helping cannabis businesses market their services without having to work around strict regulations cannabis must adhere to for traditional marketing. Bank layouts and designs also suit cannabis dispensaries’ needs of storage, security, and size.

“The great thing about bank branches is that they usually have great parking and are built for security and the ingress and egress of customers.”– Jeremy Unruh, Head of Public and Regulatory Affairs at PharmaCann.

Long gone are the days of marijuana and cannabis being controversial topics. Adults throughout the U.S. are pursuing cannabis, whether for recreational or medical purposes, and state governments are following suit, with the majority passing legalization. The pandemic quickened the industry’s growth and piqued investors’ interest, helping push forward progressive policies to protect owners and operators of cannabis businesses. Overall, the niche sector brings some obstacles, but if an investor does their research and consults with an expert, the rewards are well worth it.