Everything You Need to Know About Collision Centers

Untapped Potential for Investors

Accidents happen, and no matter how strong e-commerce becomes or if a recession hits the economy, consumers will need their cars fixed. The automobile service and repair industry proved to be one of the most resilient and productive asset classes in commercial real estate throughout the pandemic. This realization encouraged multiple-shop operators (MSOs) to start expanding their portfolio, acquiring mom-and-pop auto shops across the nation. Oftentimes, small shop owners do not realize the value in their real estate, or take full advantage of the market, losing out on profit. Real estate brokers have noticed and are now helping owners and operators maximize the value of the property, by understanding the underlying potential of the real estate and the demand for collision centers.

The current global market for Automotive Manufacturing was valued at $2.9 trillion in 2022, and it is currently growing at a CAGR of 3.1% after a period of decline in which the market fell by 0.6% between 2017 and 2022.

Collison centers are growing in rank among net lease investments. Investor demand is up, creating a competitive environment that’s driving pricing up. But many shop owners are unaware of the demand their real estate alone is experiencing and are selling their business to large operators without capitalizing on the market. Auto body repair shops require special permitting and have high construction costs due to the specialty services. This inflated cost has caused investors to seek established facilities instead of developing shops from the ground up. Local owners can take advantage of the rapidly rising rent prices by negotiating a new lease with the buyer, producing higher yields.

The global automotive repair & maintenance services market is forecasted to reach $544.5B in 2021. – Future Market Insights

Private Equity

How did auto body repair shops become trophy assets for private equity firms and institutional investors? The sector offers high growth and stability, two characteristics that large investors crave. Consumers need their vehicles, and the safety and condition of their vehicles are critical. While some retail industries are combating the growing strength of e-commerce, collision centers are unaffected, as consumers will continue to need in-person and specialized expertise after a breakdown or car wreck. Auto repair shops are one of the only sectors that are recession-resistant since consumers, no matter how hard hit by the economy, will pay to have their car fixed. It is not a discretionary spend but a requirement.

Collision repair businesses with private equity investments currently produce more than 28% of the total market. – Autobody News

MSOs are scaling auto shop businesses to better their position for future investments. As the future of car production progresses, the technology and tools needed for technical and body repairs will be much more complex and expensive compared to traditional auto shop tools, causing a strain on mom-and-pop operators. With the influx of electric vehicles, small shop owners will be challenged to train their staff in a new field. Large operators backed by private equity capital will be better positioned to invest in the required resources and education as repair shop technology evolves. MSOs also have the ability to offer better benefits and job security to employees, helping them retain skilled workers amid a tight labor market.

Top Buyers

There are several investors entering the growing market, but four notable MSOs dominate the sector in acquisitions and expansions. The most mature collision center consolidators, Caliber Collision and Gerber are buying, converting, and developing relentlessly. According to GlobeSt., new construction Caliber Collision properties are trading in the low five and even sub five cap rate range. As of Q4 2022, the average sale price of a 10,000-15,000 square foot Caliber Collision is around $4 million, with cap rates in the five percent range. The market is also experiencing an influx of up-and-coming consolidators including Crash Champions and Classic Collision. Illinois-based Crash Champions dramatically expanded throughout 2021, tripling its shop count to 175. The companies also began launching new initiatives to diversify their services, such as glass and retail services.

Caliber remains the largest consolidator in the collision repair industry, with sales approaching $6 billion. Caliber increased its national footprint from 1,400 stores in 2021 to more than 1,550 stores in 2022. – Aftermarket Matters

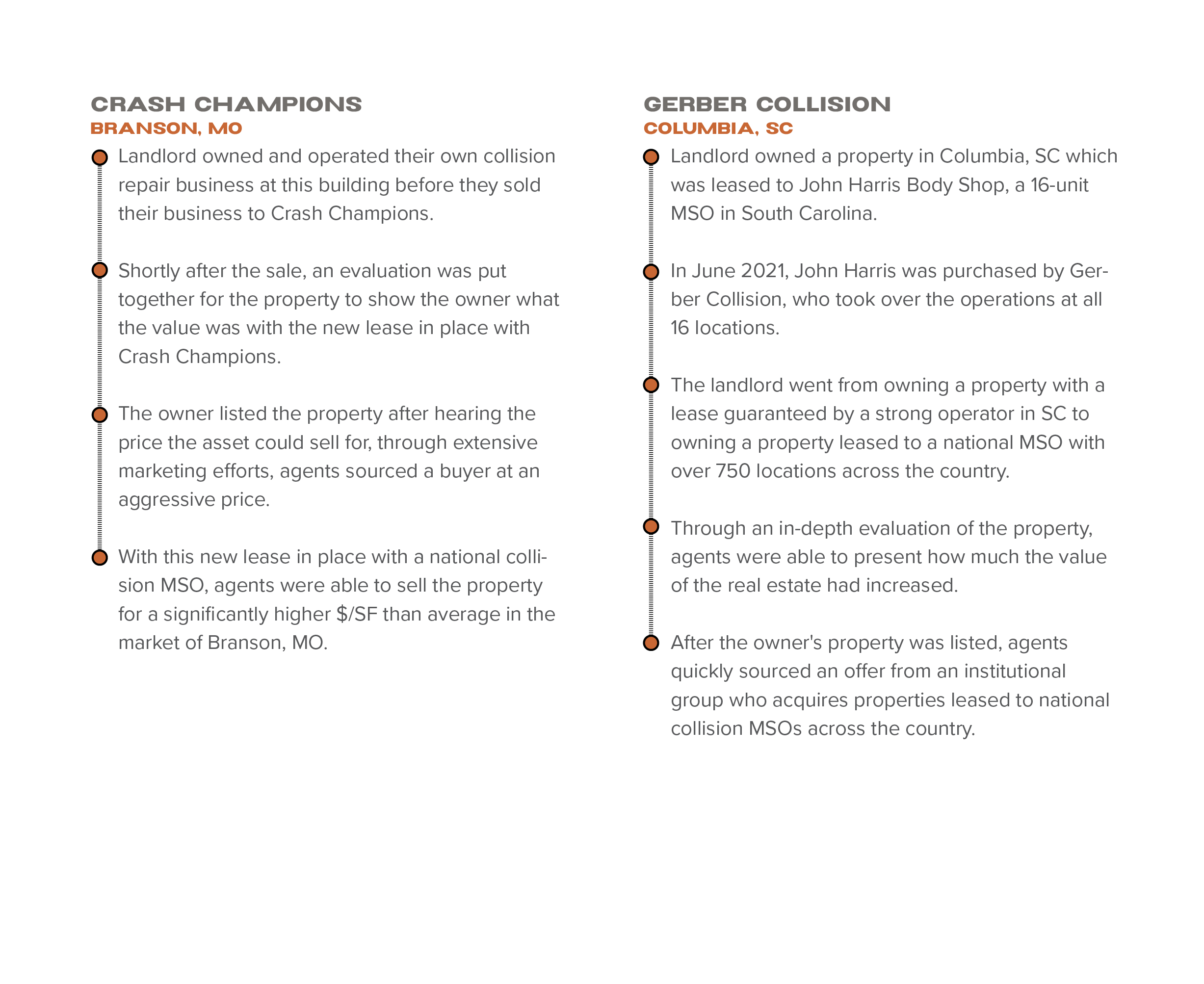

Matthews™ Auto Transactions, Case Studies

Institutional investors aren’t the only ones chasing for a piece of the collision center pie. Local investors are equally motivated to claim their stake in the market. Here are some successful auto repair transactions conducted by Matthews™ agents.