The U.S. Labor Market Post Pandemic

Since COVID-19, the workforce increased by more than 300,000 people, and COVID-19-related unemployment fell by 1.8 million. Wage growth slowed, indicating that employers were laboring to fill lower-wage posts that had been dormant for years as a nationwide labor shortage seemed to be easing. Hiring in hospitality industries like hotels, restaurants, amusement parks, and other companies that accommodated more vacationers, conventioneers, and business travelers was at the forefront. Recently, big states and cities have removed some of COVID’s last restrictions, which may spur even more business and hiring. After the COVID-19 pandemic, many businesses went into foreclosure causing a dramatic increase in the unemployment rate.

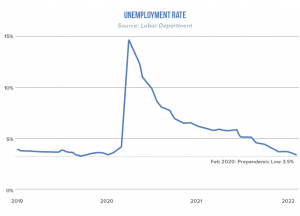

Since the beginning of 2022, unemployment recovered to a rate of 3.9 percent closing in on the 50-year low of 3.5% just before the pandemic.

Importance of Monitoring Unemployment in CRE

The number of people who are productively working profoundly impacts the commercial real estate industry. Whenever there is a decrease in unemployment, offices may shed excess space and can add to an increase in vacancy and availability. Job creation also weighs heavily on how the real estate market adjusts. If people lose their job, they tend to not move out of their houses, nor move from a one-bedroom apartment to a two-bedroom, or a rental unit into a purchased single-family home, a condo, or a co-op. Employment opportunity across a wide range of income levels can create additional demand for housing, including apartments and more affordable Class B & C housing.

Shortages in labor can also weigh on several factors within CRE as companies lack the leverage to require employees to return to office, enduring significant staffing issues. Hotels and senior housing have been hit the hardest as many are operating at partial capacity because they can’t hire enough people.

Sectors Seeing the Most Growth

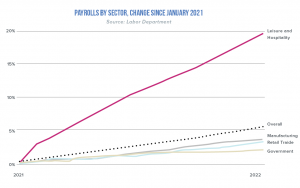

Due to the sharp drop in travel since the pandemic, one of the hardest-hit sectors was the hospitality industry. Today, leisure and hospitality have seen the most job growth accounting for 1 in 4 new jobs across the U.S. in February 2022.

Another major sector real estate investors and property managers took notice of was the industrial manufacturing sector. As e-commerce grows and two-day shipping expectations stay high, businesses are looking for more space and inventory for their products. The industrial market is already seeing a major increase in activity, and it’s projected that industrial zoned land is expected to increase about one percent in Q3 2022.

The Road to Recovery

The economy recovered faster from the pandemic than in any other previous recessions in the U.S, and banks continued lending during this time causing a huge demand in CRE space. This helped occupancy rates remain strong to support property cash flows, and as a result, CRE loans performed well with low charge-off and delinquency rates. The June job creation number surpassed analyst expectations. There are over 11 million job openings nationally, and as long as Americans have jobs and their wages grow more than long-term inflation, the performance of most property sectors should be sustained through a mild recession.